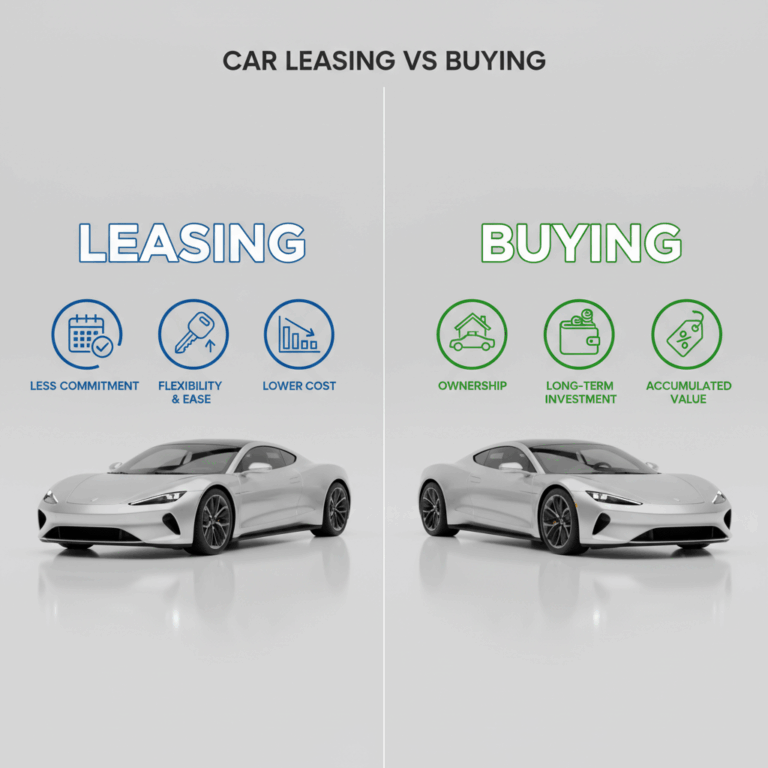

Advantages of Car Leasing

Car leasing offers several benefits that appeal to those wanting flexibility and lower upfront costs. This method allows drivers to enjoy the latest models with manageable monthly payments.

Leasing is attractive for its ability to provide access to higher-end vehicles than one might afford through buying, making luxury cars more reachable without a large initial investment.

Lower Monthly Payments

Leasing a car typically involves lower monthly payments compared to buying. Since you pay only for the vehicle’s depreciation during the lease term, expenses are spread out more affordably.

This structure results in less financial strain each month, enabling individuals to drive a newer or more expensive vehicle while maintaining a balanced budget.

Access to High-End Vehicles

Leasing gives drivers the chance to experience luxury or high-end vehicles that might otherwise be unaffordable. You only pay for the vehicle’s lost value during the lease period.

This means enjoying premium brands and advanced features without the burden of full purchase cost, making it easier to drive cars with cutting-edge technology.

Disadvantages of Car Leasing

Car leasing has its drawbacks that may not suit everyone. One major issue is the lack of vehicle ownership, which can limit long-term benefits and flexibility.

Additionally, leased cars often come with mileage restrictions and potential extra costs, which can add up and reduce the overall value of the lease agreement.

No Ownership

When you lease a car, you do not own it. This means you cannot modify or sell the vehicle and must return it at the end of the lease term.

This lack of ownership can be limiting for those who want to keep their vehicle long-term or treat it as a personal asset.

Mileage Restrictions

Lease contracts typically include strict mileage limits. Exceeding these limits results in additional fees, which can make leasing costly for high-mileage drivers.

These restrictions can restrict your driving habits, especially if you frequently travel long distances.

Additional Costs

Although monthly lease payments are lower, there can be hidden costs such as insurance, maintenance, and penalties for excessive wear and tear.

These extra expenses may increase the total cost of leasing, reducing its overall financial advantage compared to buying.

Advantages of Car Buying

Buying a car grants you full ownership, providing independence and the freedom to keep the vehicle as long as you want without restrictions.

Owners enjoy the benefit of no mileage limits, which allows for unrestricted driving without incurring additional fees or penalties.

Over time, buying can be more cost-effective since once the loan is paid off, you no longer have monthly car payments, saving money in the long run.

Full Ownership

Purchasing a car means you completely own it after paying off any loans. This allows you to customize, sell, or keep the vehicle forever.

Ownership also provides peace of mind since you won’t have to worry about return conditions or lease-end charges.

This permanence appeals to drivers wanting a long-term investment and full control over their vehicle.

No Mileage Limits

Car owners face no mileage restrictions, enabling them to drive as much as they want without financial penalties or contract worries.

This freedom suits those who commute extensively or enjoy long road trips without constraints.

It eliminates the stress of monitoring distances and additional costs tied to exceeding lease limits.

Interesting Fact

Many buyers use their vehicle for over 10 years, maximizing the value and avoiding repeated payments common with leasing.

This extended use can spread out the cost and offset depreciation expenses effectively.

Cost Effectiveness Over Time

Buying often requires larger upfront costs, but once paid off, the absence of monthly payments results in significant savings.

Long-term ownership avoids lease renewal fees and keeps you from continuous depreciation charges tied to leasing.

Thus, the total cost of ownership tends to be lower over many years despite initial expenses.

Disadvantages of Car Buying

Buying a car requires a higher initial investment compared to leasing, often involving a significant down payment and larger monthly loan payments. This can strain your budget upfront.

Additionally, buyers face the risk of depreciation, where the car’s value decreases quickly, potentially leading to financial loss if you resell or trade in the vehicle later.

Higher Initial Payments

Purchasing a car demands larger upfront costs, including the down payment and taxes. Monthly loan payments are usually higher than lease payments, impacting cash flow.

These substantial initial expenses can be challenging, especially for buyers without sufficient savings or those needing to keep monthly budgets tight.

Depreciation Risk

When you own a car, you bear the full depreciation risk. Vehicles lose value rapidly, particularly in the first few years, lowering resale value significantly.

This depreciation means you might owe more on your car loan than the vehicle is worth, which can be financially taxing if you decide to sell or trade it in early.