Key Documents for Accident Reporting

Properly documenting an accident is essential for insurance and legal processes. The first key document is the Friendly Accident Report Form, which collects critical details of the incident.

This form includes data such as the accident’s date, time, and location, plus personal and vehicle information of all involved drivers. Accurate completion ensures a swift claims procedure.

Friendly Accident Report Form

The Friendly Accident Report Form is a standard document provided by insurers, typically kept in the vehicle. It records vital facts like driver names, license numbers, and insurer policy details.

Additionally, it requires a clear description of how the accident occurred and visible damage to each vehicle. Both drivers should sign the form to confirm agreement on the recorded facts.

If injuries are present, even minor ones, they must be noted on this form as it is crucial for claims and legal purposes. This document serves as the primary evidence for insurers to assess responsibility.

Medical Documentation

In cases involving injuries, preserving all medical documentation is vital. This includes medical reports, test results such as X-rays or CT scans, and hospital discharge summaries linking injuries to the accident.

These documents support legal claims and insurance compensation requests by proving the extent and cause of injuries sustained. Proper medical records ensure the victim’s rights are protected.

Essential Information to Record

Recording accurate details after an accident is vital to support insurance claims and legal actions. This includes specific information about the accident and the involved parties.

Careful documentation helps avoid disputes, speeds up the claims process, and provides evidence for insurers and authorities.

Accident Details and Driver Information

Essential accident details include the date, time, and exact location of the incident, such as street number or kilometer point. This information sets clear context for the accident.

Driver information must be precise, including names, addresses, phone numbers, and driving license numbers. This ensures correct identification and communication throughout the claim process.

A clear description of how the accident happened should be documented. This narrative clarifies fault and helps insurance companies evaluate liability efficiently.

Vehicle Information and Damage Description

Record vehicle details like make, model, license plate, and insurance policy numbers. This data is critical for verification and claim handling.

Describe the visible damage to each vehicle thoroughly but concisely, noting affected areas. Accurate damage descriptions aid in estimating repair costs and liability.

If possible, detail the positions of vehicles before and after the accident to provide context for the collision impact and fault assessment.

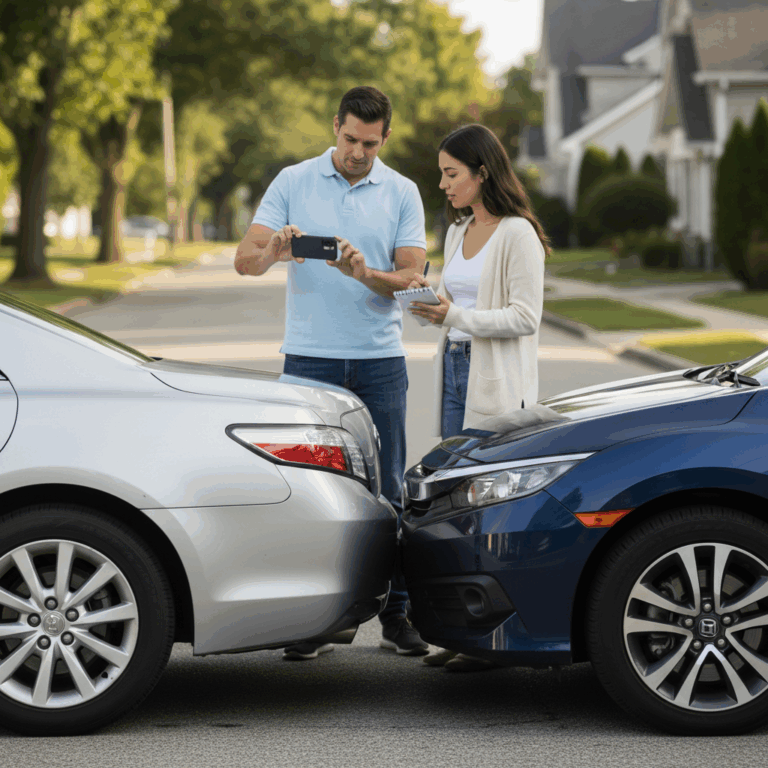

Photographic Evidence

Photographs are one of the most powerful evidence forms. Capture images of the accident scene, vehicle positions, and damages clearly from multiple angles.

Include photos of relevant road signs, traffic signals, and weather conditions to support understanding of the accident environment.

Tip for Effective Photos

Use a phone or camera with good resolution and take shots immediately after the accident. Label photos with date and time if possible to maintain evidence integrity.

Actions After the Accident

After an accident, certain actions are essential to ensure proper documentation and support for insurance or legal claims. Prompt steps help validate the incident details.

One critical step is obtaining signatures from all involved parties on the accident report, confirming agreement about what happened. Authorities may need to be involved in specific cases.

Obtaining Signatures and Involving Authorities

Both drivers must sign the Friendly Accident Report Form to confirm the facts listed are accurate and agreed upon. This signature is a key element in validating the report.

If there is any disagreement or if injuries occurred, it is crucial to contact the police. An official report ensures impartial documentation and is often required for legal or insurance purposes.

Police involvement provides a formal record of the accident details and can assist in clarifying fault or managing complex situations. Their report supports a transparent, fair claims process.

Submitting and Using Documentation

Once the accident documentation is complete, prompt submission to the insurance company is essential. This step accelerates the claim process and ensures accurate assessment of the incident.

Proper use of the documentation supports both insurance claims and potential legal actions, providing clear and verifiable evidence for all parties involved.

Sending the Report to the Insurance Company

After filling out the Friendly Accident Report Form, it should be sent to the insurer as soon as possible, ideally within the shortest time frame allowed.

Many insurance companies now offer online submission platforms, making it quick and convenient to send reports and attached evidence like photographs and medical documents.

Timely submission avoids delays in claim processing and helps insurers assign adjusters promptly to evaluate the case.

Legal and Insurance Claim Support

All compiled documents serve as crucial support in both legal proceedings and insurance claims. This includes reports, photos, and any medical records related to injuries.

Having complete and accurate documentation strengthens your position by providing solid proof of the circumstances and consequences of the accident.

In case of disputes or injury claims, these documents assist lawyers and insurance adjusters in reaching fair resolutions efficiently.